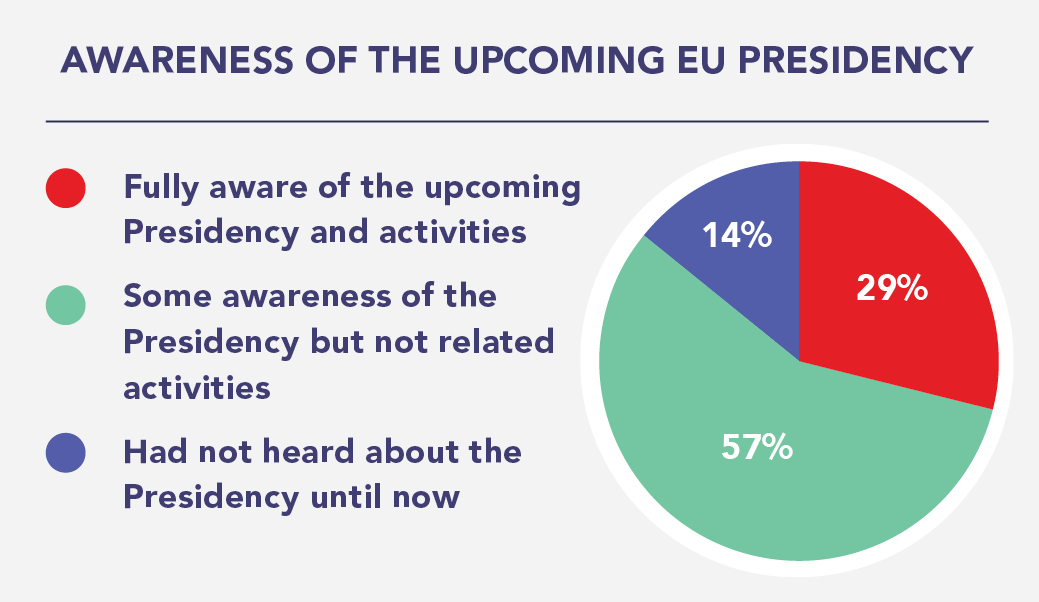

Ireland is preparing to take on the Presidency of the Council of the EU in the second half of 2026, presenting an important opportunity to shape policy and influence at EU level.

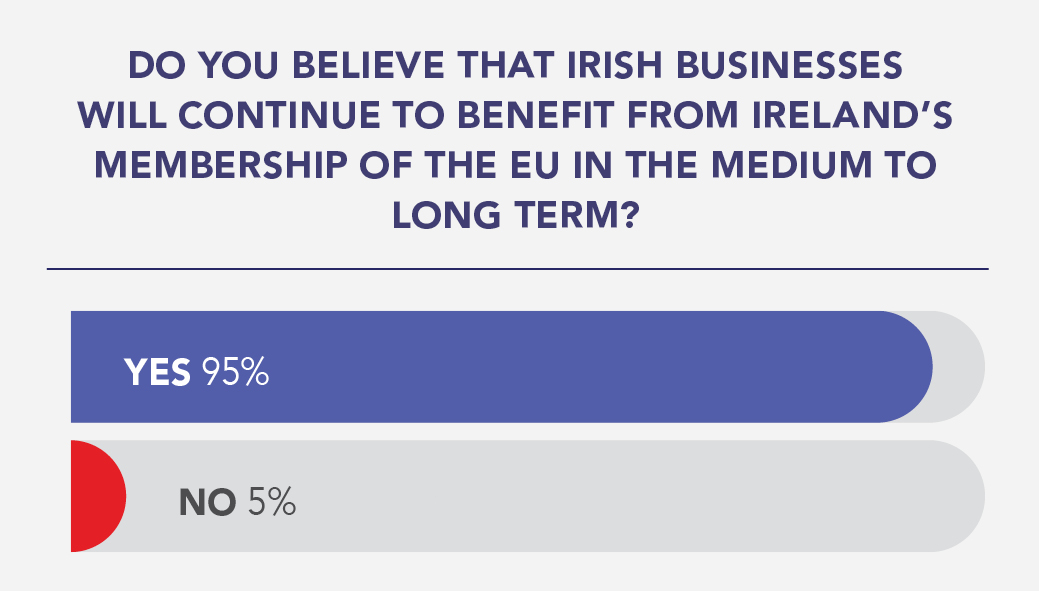

Respondents were positive about Ireland’s EU membership to date, highlighting the importance of the Single Market, talent mobility and investment.

Almost all respondents believe that Irish businesses will continue to benefit from EU membership into the future, and awareness of the upcoming EU Presidency was high among respondents.

Advancing economic competitiveness, progressing regulatory simplification and supporting talent and skills, as well as security and defence, emerged as the top priorities for business when it comes to Ireland’s EU Presidency.

Respondents underlined the importance of harnessing the EU Presidency to showcase Ireland as an attractive business location, promote Irish business abroad and deliver tangible regional benefits.

80% of respondents expressed confidence in the Irish economy in Q4 2025, a slight increase on recent survey results.

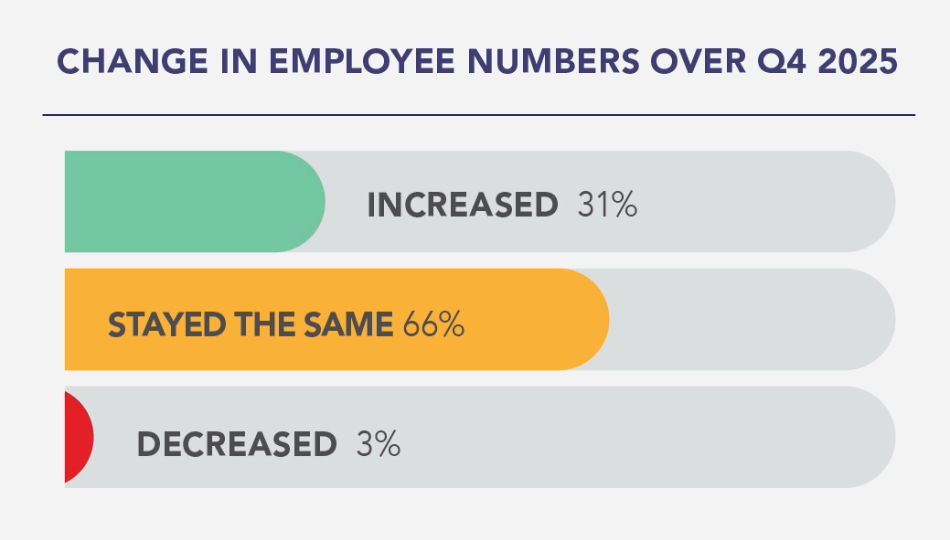

In Q4 2025, 66% of respondents reported that their employee numbers remained the same, while 31% saw an increase in employees.

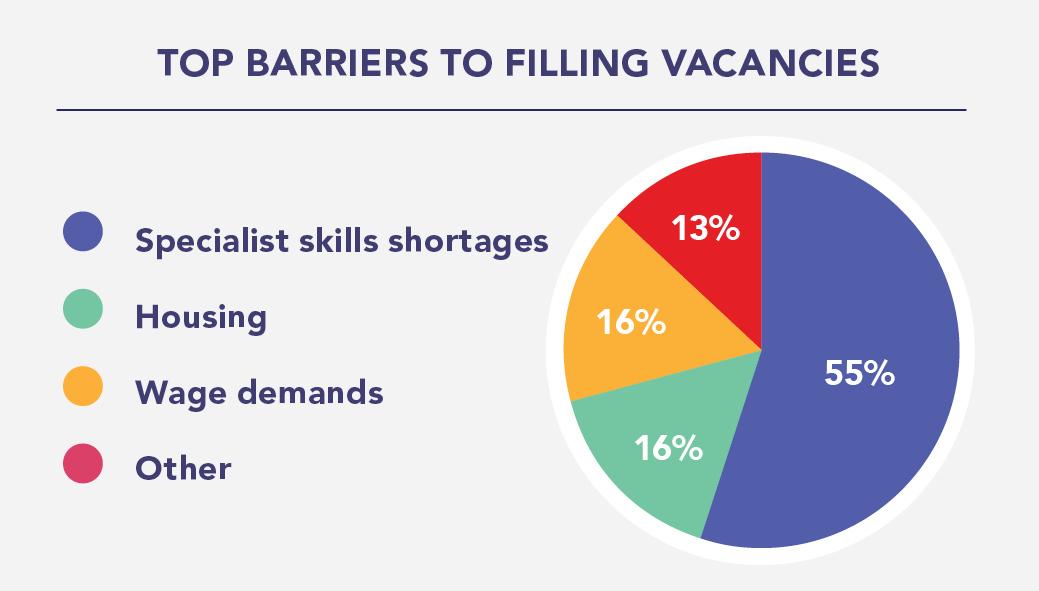

Of the 41% of respondents with vacancies advertised at present, 40% reported difficulties with filling these roles (with roles remaining vacant for 3 months or more). Specialist skills shortages emerged as the top barrier to filling vacancies.

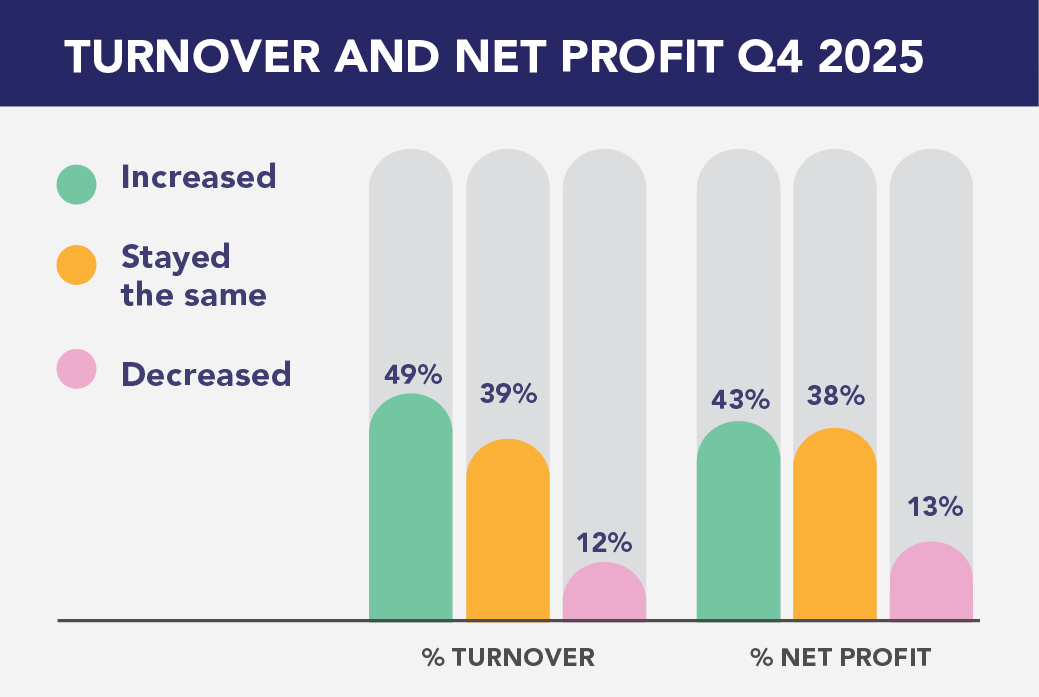

Turnover and net profit reported across Q4 2025 remained consistent with recent survey results.

Looking ahead to Q1 2026, nearly 50% of respondents predict an increase in turnover and 40% expect an increase in net profit.